Consumer surplus

What is consumer surplus?

Consumer surplus is a measure of the consumer benefits that arise from the competition of companies in the market. The definition of this concept includes a mini formula: a surplus occurs when the price a customer is willing to pay for a product or service is greater than the actual price of the product or service. The meaning of this formula is quite simple: if a consumer is willing to pay more yet pays less, then there is a consumer surplus. This concept appeared in economics in 1844. Then the concept of consumer surplus was developed to measure the social benefits of the goods available to society: roads, bridges, and canals. Initially, national governments used it to develop their tax policies. Then the mechanism for calculating consumer surplus moved into business.

Now consumer surplus has its own formula, which looks like this:

(½) x Qd x ΔP

According to this formula, to find consumer surplus, you need to multiply 0.5 by the number of goods in the equation of supply and demand, and then multiply it by the difference in the price that the consumer is willing to pay for the product and the price of the product in case of equality (in a situation where supply and demand are equal). Thus, Qd is the number of goods in equality, and ΔP is the difference between Pmax (the price the consumer is willing to pay for the product) and Pd (the price of the product when supply and demand are equal). This is the consumer surplus formula. The consumer surplus derived by an individual from a good or service is expressed in money.

Can consumer surplus exist in the ideal competitive environment?

Consumer surplus in perfect competition theoretically exists. At the market, that is, the equilibrium price, a surplus is created for all parties to the deal: consumers who are willing to pay more pay only the market value of the goods, and suppliers who are ready to accept a lower price sell the goods at market value. But in reality, such a situation practically does not occur, because there are simply no markets with perfect competition.

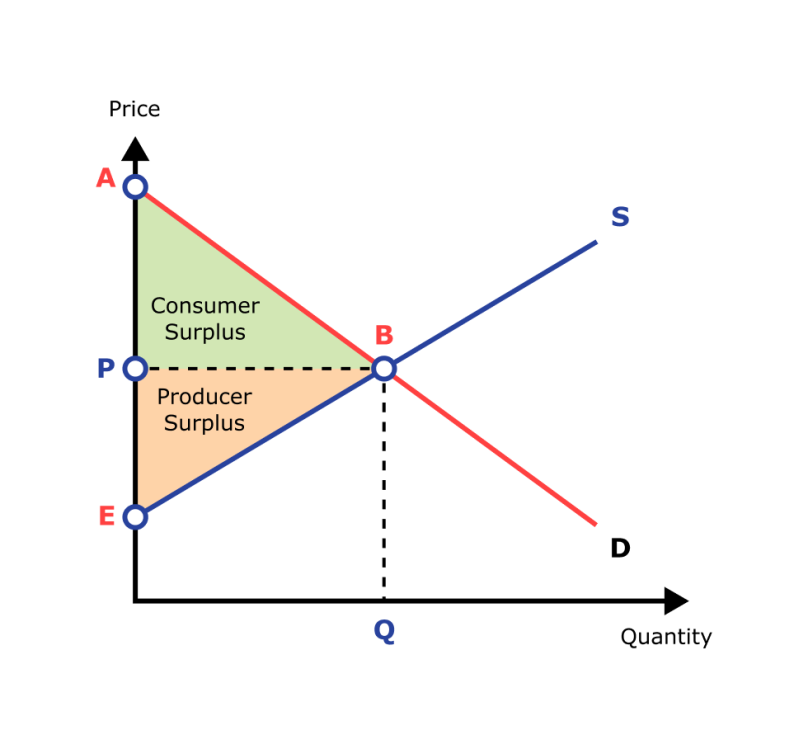

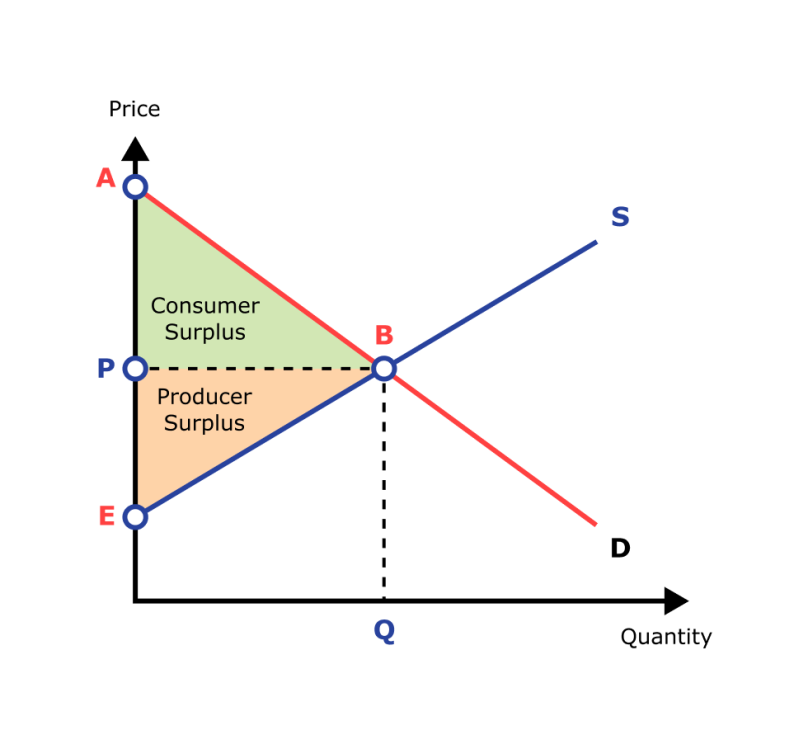

Consumer surplus vs producer surplus

Consumer surplus refers to the monetary benefit that the buyer receives. The customer buys the product cheaper than they were willing to pay for it. Producer surplus is the difference between the lowest price a good can sell to the market and the price a buyer is willing to pay for it. By adding consumer surplus and producer surplus, one can find the total surplus, or the total welfare of the society. This indicator is used to determine the market's well-being. An increase in public welfare signals that consumer surplus is increasing. Of course, numerous factors affect the customers' welfare, but surplus also plays an important role. It will change if consumers lose their wealth or even abandon these kinds of products. An increase in product prices always leads to a decrease in consumer welfare and a decrease in consumer surplus.

Here's what the consumer and producer surplus graph looks like:

Consumer surplus vs economic surplus

Consumer surplus is equal to the difference between the highest price a consumer is willing to pay for a product and the actual price they will pay for it. In turn, producer surplus is equal to the difference between the market price of a product or service and the lowest price the producer charges for that product. And economic surplus refers to both consumer surplus and producer surplus. It's like an umbrella term. The key is that the surplus should be monetary.

Let's have a closer look at the difference between these concepts. Think of consumer surplus as being willing to pay $50 for a pair of sneakers, and $70 if you really like them and they have a few extra features that set them apart from the competition. You find a model that suits you in everything for $40. It has no features that could make it more expensive. You buy it for $40, and consumer surplus equals $10. If the model had any special features, the consumer surplus would be $30. Consumer surplus is your benefit. You can even call it a monetary gain: you didn't pay those $10, although you could and were even ready to. Except you already have that money.

Producer surplus is when you sell sneakers not for the $20 they cost to manufacture but for $70. You add to the price of a pair of sneakers the cost of logistics, packaging, marketing, and distribution. The absolute minimum that you were willing to set as the price of a product was $50. This minimum would not allow you to make money. But you - as a manufacturer and businessperson - love money, so you began to study the market to understand how much the consumer is ready to pay for these sneakers. You found out that a consumer can pay up to $70, so you set a floor price of $70. This price would make it possible to return your investment and earn money. You make a profit of $20 (because you spend $50 on the shoes themselves, and on their logistics, packaging, advertising, marketing support, and so on).

Economic surplus is both consumer surplus and producer surplus. Each of these surpluses is monetary, as it is expressed in financial form. Economic surplus is sometimes called the total surplus, that is, a combined one. This is when consumer surplus is superimposed on producer surplus.

The history of economic surplus

The concept of consumer surplus was first developed by French economist and civil engineer Jules Dupuit. This happened in the middle of the 19th century. Yet the popularity of the term was brought about by the book "Principles of Economics" by the British economist Alfred Marshall, which was published in 1890. There, Marshall attempted to define what economic surplus is. This is why economic surplus is now sometimes called Marshall's surplus.

Consumer surplus graph

Total consumer surplus is most often shown on a special chart. It can also be a diagram. It all depends on the purpose for which you create the visualisation. Most frequently, consumer surplus is shown on the demand curve. The price is demonstrated on the vertical axis, and the quantity demanded is shown on the horizontal axis.

Consumer surplus is shown graphically as the area above the price and below the demand curve. The demand curve has a negative slope due to the law of diminishing marginal utility and is scientifically justified. On graphs of this kind, one can see an illustration of the difference between the cost that a consumer is willing to pay for a product and the price that they actually pay. Sometimes consumer surplus is negative, indicating that the product is worth more money than customers are willing to spend on it. Then the seller will either have to find a new market where consumers are willing to pay more, or figure out how to make the product cheaper, or try to sell it in the existing market for the same price as it was before, but promoting its value and uniqueness.

How to calculate consumer surplus

Problems with finding consumer surplus usually arise for all businesspeople who have not studied special (economic and financial) subjects. Here is what you need to know to correctly calculate consumer surplus:

-

The surplus always increases when the price of a commodity decreases. This rule works the other way around as well. For example, consumers are willing to pay $10 for the first item and $5 for the fortieth item (the products are the same, take bathroom boxes or magazines for example). If all forty items are sold at $5 each, then they are selling with consumer surplus. This is assuming that demand remains the same.

-

If demand is elastic, the surplus is equal to zero. If demand is inelastic, consumer surplus will be infinite.

-

The surplus depends on how much consumers are willing to pay for your product. To calculate consumer surplus using the formula (½) x Qd x ΔP, you need to find out how much consumers are willing to pay for your product. For example, you found tickets to another country for $100, but you know that these tickets usually cost $300 or more. Your consumer surplus is $200. Buyers typically refer to this as a benefit, but for a business, this is consumer surplus (not to be confused with consumer overplus, that is, the amount of demand that you cannot satisfy).

Consumer surplus examples

You can find examples of consumer surplus in every area of business. Thus, consumer surplus often appears when selling airline tickets. Ticket prices fluctuate, and there are aggregator sites and coupon sites that offer great discounts. A consumer who wants to find tickets at a discount will certainly be able to do this. There are many competitors on the market, and airlines constantly hold promotions and reduce the cost of their services. Nevertheless, before important dates, such as holidays, weekends, or major conferences, ticket prices go up. Even if you buy them a few months before the event or holiday. So consumer surplus can turn into producer surplus in just a couple of hours.

Consumer surplus, that is, the benefit to the buyer, is frequently present in resale. Let's say you didn't like the shirt your relatives bought for you while travelling. It is either too small or too large for you, and you can't wear it in any way. You decide to sell it on a website for used items. You can set the cost of the shirt both below the face value (that is, the price at which it was bought in another country) and above it (if the shirt is unique: it is the last of the collection, it is impossible to find one any more, it is hand made, and so on). If the price is below face value, you will be dealing with consumer surplus, that is, with a benefit for the buyer. If it's higher, you will face a producer surplus with a benefit for you.

Another example of consumer surplus is the cost of smartphones after the release of a new model from the same manufacturer. Every year, the cost of Apple technology, which has not just been released, is declining. Although consumers are often willing to pay for last year's smartphone the money that was asked for it before the presentation of the new gadget. However, sellers come up with various tricks: they offer a charger and a case with a protective screen for a smartphone, special apps that protect the phone from hackers, and the like. However, they still cannot always cover consumer surplus, and customer satisfaction with additional offers decreases with each new smartphone purchase. Thus, consumer surplus in a monopoly is an incentive for the development of the monopolist and its competitors.

Consumer surplus appears wherever there is a benefit for the buyer. It is the growth driver of the coupon market, ticket and hotel aggregators, and promo and discount sites. Consumer surplus arises in the market because the consumer receives more than they pay for. So, discounts in grocery stores, low-balling sellers on marketplaces, and reduced cost of theatre tickets can be cited as an example of consumer surplus. Sometimes experts call consumer surplus a situation in which the value of the emotions received is several times higher than the cost in financial terms. For example, you decide to go to the ballet, and you liked it so much that the hundred dollars you spent on a ticket seem nothing to you (although in reality, it may be a lot of money for your family). However, there is a problem with such a definition: it is impossible to guess which viewer will love the performance, and which one will hate it. Therefore, producers cannot raise ticket prices for performances, unless they happen in places like Disneyland - well-established and extremely popular spots that include hotels, restaurants, parks, theatres, and the like.

You see consumer surplus every day you shop. Have a closer look at how much you are willing to pay for a product and how much you actually pay, and you will find out what it looks like in real life.